Bob Doll, Chief Equity Strategist of BlackRock makes his 10 predictions for 2011:

1. US growth accelerates as US real GDP reaches a new all-time high.

2. The US economy creates two to three million jobs in 2011 as the unemployment rate falls to 9%.

3. US stocks experience a third year of double-digit percentage returns for the first time in more than a decade as earnings reach a new all-time high.

4. Stocks outperform bonds and cash.

5. The US stock market outperforms the MSCI World Index.

6. The United States, Germany and Brazil outperform Japan, Spain and China.

7. Commodities and emerging market currencies outperform the US dollar, the euro and the Japanese yen.

8. Strong balance sheets and free cash flow lead to significant increases in dividends, share buybacks, mergers and acquisitions and business reinvestment.

9. Investor capital flows move from bond funds to equity funds.

10. The 2012 Presidential campaign sees a plethora of Republican candidates while President Obama continues to move to the political center.

They are pretty upbeat and positive.

There is a post up with regards to Dr Copper. Copper, has been one of the pre-eminent economic forecasting tools, outperforming economists at every turn.

From this blog:

In a classic bullish sign for the New Year, copper advanced to a record high in overnight trading.

Copper was up 1.4% to $9,631.75 a metric ton on the London Metal Exchange, passing the record set yesterday, according to Bloomberg.

Other bullish indicators going into the last day of 2010 include rising stock markets in Asia and a two-week low for the yen against the New Zealand dollar.

The only holdout was oil, which fell below $90 yesterday.

Read more: http://www.businessinsider.com/dr-copper-says-happy-new-year-2010-12

Now, the post doesn’t actually distinguish whether this is bullish in a speculation sense, via higher prices, reflecting increased inflation, or, bullish in an economic sense, implying improved demand for copper in its useage.

To try and differentiate, let’s look at the warehouse stocks: if it is increased demand, or falling supply, rather than just rising prices, we should see falling inventory levels.

What we actually see is that historically, inventories are high. Yes, there has been a drawdown of inventories, but from very high historical levels: thus we can conclude that the higher prices indicate not increased economic activity, but rather increased inflation.

Goldman Sachs, the perennial US Investment Bank, one of the few to survive the 2008 bust and actually come back stronger. Of course, they didn’t actually perform that much better: they were the recipients of TARP bailout money, Warren Buffett bailed them out with a further $5 billion and generally speaking, they very nearly went under.

The lines of business that they follow are diversified:

*Primary Dealer status

*Underwriter of Bond issues

*Underwriter of IPO’s

*Market makers

*Proprietary Trading

*Hedge Funds [in house]

*Trading Desk [trades firms capital]

*Analyst services [Macro/micro economic/stock/bond]

*Investment Banking [Merger & Acquisitions]

Their clients are Government, Institutional investors, Pension Funds, Mutual Funds, Corporations, Sovereign Wealth Funds, Hedge Funds, High Net Worth Individuals and Foreign Governments to name but a few.

So if you could become a client of Goldman Sachs, it would be a good thing? Would you benefit from all their connections and market savvy? As opposed to say a smaller boutique advisory or hedge fund.

Let’s examine their various lines of business, to see if we could as individuals, benefit financially from being a Goldman client.

Primary Dealers are purchaser’s of US government Treasury debt. The government, for whatever purpose, requires cash, thus will float Treasury paper: the Primary Dealers bid on this paper, and are assigned a dollar value based on their bid.

The current Quantitative Easing [QE II] sees the Federal Reserve repurchasing at a premium, this recently floated Treasury paper, creating Reserves at the Federal Reserve, which is money creation, as they monetise this US government liability.

For Goldman Sachs, this is a highly lucrative, low risk undertaking. Would you as an individual be able to partake? The short answer is no.

Goldman Sachs will underwrite Corporate debt. A Corporation will decide, for whatever reason, that they require debt capital and wish to raise it via the financial markets: Goldman Sachs will, for a fee, agree to sell this paper to the market, guaranteeing a certain price. Through their connections and reputation, the Goldman sales team now attempt to place this new Corporate debt with various Institutions looking for a specific yielding asset of a specific maturity, for example Insurance Companies and Pension Funds.

Again, would you, as an individual, be able to partake and profit from this line of business? The short answer, is again, no.

Goldman will also underwrite Initial Private Offerings, or IPO’s. Essentially taking a private business public onto the Stockmarket. Again, Goldman charge fees, and guarantee to place a specific number of shares at a specific offer price, thus allowing early investors and owners to sell out, or diversify their investments.

Here the individual could benefit. Potentially, Goldman will likely allocate a specific number of underwritten shares for their clients. In an IPO that is hot, this could definitely be a bonus to the individual, particularly if the company is high quality and in high demand. Of course, the individual can always purchase shares on the open market, although, if there is a first day pop in price, there may be a significant premium to be paid.

Goldman Sachs is also a significant market maker on the various US bourses, in stocks and in the debt markets that often trade by appointment. Market making is highly competitive and specialised, and would not be available to individuals.

Goldman also provides trading capital to various Proprietary Trading firms, Bright Trading being one example: Goldman provide the trading capital that allows the Prop Traders to utilise high leverage, a small sliver of capital supporting huge trades. Leverage of 50X is pretty common.

Would the individual client of Goldman benefit from this? Again, the short answer is no.

Goldman also trades their own firms capital: eat what you kill is their credo. This area of their business tends to be highly controversial, as, their trading desk has taken opposite positions to securities that Goldman have sold to clients: in the most egregious cases, taking opposing positions against securities that Goldman have created, packaged, and sold to Institutional clients. The famous example being the Mortgage Backed Securities [MBS] that Goldman shorted via derivatives.

Once again, the question, would you as a client, benefit from this? The short answer, again, no. The Goldman trading desk is notoriously secretive, with good reason.

Goldman Sachs Research:

Equity Research

Equity Research focuses on company-specific research and analysis. Industry and sector- teams analyze companies in the stock markets of the region to develop investment ideas. These sector teams also work with macro, quantitative and derivatives research teams to identify investment ideas.

Economic Research

The Economic Research group formulates macroeconomic forecasts for economic activity, foreign exchange rates and interest rates based on the globally coordinated views of its global and regional economists.

Strategy and Commodities Research

Strategy and Commodities Research groups provide market views, forecasts and recommendations on asset allocation and sectors and investment strategies. Portfolio and quantitative strategy teams contribute additional insight and analysis.

Credit Research

Credit Research analysts assess corporate debt and cover specific industry sectors to identify and communicate investment opportunities and make recommendations. Equipped with a fundamental understanding of trends and issues, research teams analyze companies within the context of their particular industry.

Global Markets Institute

The Global Markets Institute is the public policy research unit of Goldman Sachs Global Investment Research. Its mission is to provide research and high-level advisory services to policymakers, regulators and investors around the world. The Institute leverages the expertise of Research and other Goldman Sachs professionals, as well as highly-regarded thought leaders outside the firm, to offer written analyses and host discussion forums.

So let’s take a look at some specific Goldman research, I have used this document as a source:

We identified five key themes from 2Q earnings conference

calls: (1) Uncertain economic outlook; (2) Focus on margin

improvement; (3) Disciplined hiring practices; (4) Use of large

cash balances; and (5) Mitigated impact of dollar weakness.

High unemployment and weak consumer confidence made

firms reluctant to hire new workers and invest for growth.

Expanding on one of these five themes:

Large cash balances used for buybacks and debt reduction

Free cash flow generation has been strong and boards are authorizing fresh repurchases. Many previous authorizations have been exhausted. Debt reduction has been more prevalent than in prior quarters.

Expanding again:

August 11, 2010

United States: Portfolio Strategy

Goldman Sachs Global Economics, Commodities and Strategy Research

Theme 4: Use of large cash balances

Corporate balance sheets remain flush with cash. Managements remain committed to returning cash to shareholders and are showing an increasing willingness to invest for growth. In 2Q companies continued to pay down debt, raise dividends, and buyback

stock and direct money to pension funds. The desire to expand margins and capture limited growth opportunities in a slow growth world has also spurred some spending on capital investments and advertising. Free cash flow generation has been particularly strong and many boards are authorizing fresh repurchases. Anecdotally, debt reduction seems more prevalent than during previous quarters.

Ford (F) expects to have net positive cash by end of next year

It’s clearly a really positive development because we’re managing our uses of cash, and we’re looking at the overall business environment, and it appears to us, with all of our fundamental assumptions, that we’re going to be able to continue to improve the balance sheet and pay down the debt. And that’s why we’re very pleased to give the guidance that we’ll be in a net positive position in cash at the end of next year.

Caterpillar (CAT) comments on priorities for its cash balance

…priority number one being to grow the business, has not changed, and we may have more opportunities, based on one, just the playing field that’s out there today, and two, some valuations. So, we’re looking in every corner, and all of our businesses are concentrated on that today where we can do that. Secondly, our pension plans, thirdly our capital, and then finally, dividends and share buybacks…General Electric (GE) expects to hold more cash than in the past

You know, I would say clearly we’re going to have more cash in the future than we had pre-crisis, but with $25B we’re going to have substantial flexibility to do the things we want to do to grow the company.

The entire report carries on in pretty much the same way. There are some recommendations scattered along the way, but the overall impression is one of a fairly shallow analysis. There is nothing really that the individual could take away and apply to his own portfolio.

Which leads into the Goldman Sachs Hedge Funds. Goldman run a number of funds, everything from infrastructure to stocks and commodities. I don’t know the fees on these funds, nor the minimum amount required to invest, but I’m willing to guess both are fairly substantial.

In conclusion, Goldman, probably does not serve the smaller individual investor as well as a smaller, more individual advisory or Hedge Fund, as their lines of business are so divorced from the smaller investor, and I suspect their research papers only give very limited information, as Goldman will, due to their other lines of business be constrained by inside information limitations.

Politics:

Ron Paul will make inroads against the Federal Reserve and limit the actions of Bernanke. Without QEIII, IV, V, the markets will become dysfunctional [again] and rediscover the fact that markets can fall as well as rise.

Corporate Earnings:

Will start to deteriorate at the lower stages of production and consumer margins. This is due to the higher costs of production not being passed forward to the consumer. The result being a compression of margins. This compression of margins will cause increased liquidations of the lower profit margin firms, leading to a fall in competition, which will then allow an increase in consumer prices, and an equilibrium to be restored to the pure rate of interest.

Black Swans:

Will impact markets in 2011. Black Swans are unpredictable, have outsize effects and are outlier events. So, no-one, by definition can, or will predict the nature of the Black Swan, but, we haven’t had one for a while, so one may wander along. Black Swans also have outsize effects, thus a significant jump in volatility will take place.

Unemployment:

Will not significantly change, unless, it starts to deteriorate further. The reason being that the government are following all the incorrect policies in regard to employment. The devaluation of the dollar, and the inflation it engenders is the Keynesian prescription to lower the real wage. Two factors mitigate this stimulus to employment [i] Capital is also cheap, and cheaper than labour, thus, no shift to labour from capital will take place [ii] Cheap labour is available abroad, thus, the offshoring in manufacturing labour intensive industries will continue.

Unions:

Will start to recruit higher labour participation, which will raise, or try to match the inflation level in wage demands. This will raise further the real wage rates, thus reducing employment further. An increase in militancy is on the cards a la Europe.

Military Spending, Wars, Propaganda:

Will all increase. The Obama election promise of leaving Iraq, Afghanistan, comes to naught, as US involvement in Afghanistan, the graveyard of Imperialism, draws further US troops and military budget. The propaganda will increase, the threat of enemies, as yet unknown, will be sold to a US public, who may, finally be seeing through the charade.

QE I, II, III, IV:

Will continue and are nothing more than inflationary bailouts, first of the Banks, and now of the government. As such, any exit, is impossible, unless you are willing to deflate. Bernanke, categorically is not: thus, unless his hand is forced by Congress, inflation will continue and start spreading outside of the financial markets.

Gold & Silver:

Will continue their bull markets into 2011. The inflationary stimulus will continue to drive the conversion of fiat trash into hard money.

Oil:

Will also continue it’s inflationary appreciation, even though the higher nominal price inhibits demand. Increasing difficulties in supply, via production falloffs, lack of new supply, etc. contribute to the inflationary surge.

Ag. Inflation:

Will surge in 2011. The highly competitive consumer distribution businesses, Safeways, WalMart, etc. will see diminished competition via a compression of their margins, thus driving consolidation through the industry. Once the shakeout is complete, consumer prices will rise substantially, reflecting the inflation in the higher stages of production.

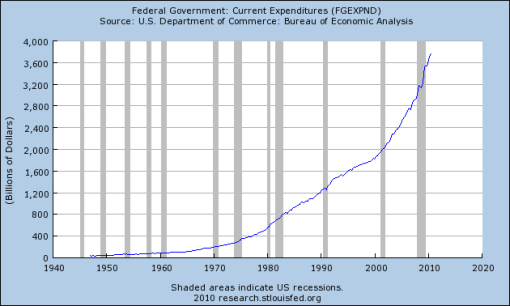

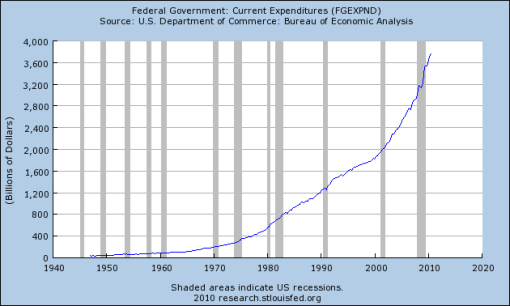

Government:

Will continue to grow, increasingly adding legislative roadblocks to the capitalistic and entrepreneurial model, which, via the increase in Socialism, will delay and retard any economic revival. This will continue the trend of Federal government spending, a proxy for the interference of the government in the economy.

Deficits:

Will continue to expand, necessitating the continued expansion of the Balance Sheet of the Federal Reserve, which by any other name is money printing. This will have several consequences, none of them good. The first we’ll examine will be the effect on nominal interest rates.

As can be seen from the chart, longer term [30yrs] interest rates are set to rise through the trendline that has been in place for 20yrs. Interest rate trends are long trends: thus the profligacy of the government is set to trigger a rise in interest rates.

There are positive and negative consequences on higher interest rates: for government, the consequences are bad, higher costs, across the yield curve, in an environment of expanding deficits, will bring increasing pressure to continue the inflationary printing, as the costs cannot be met from tax revenues; this increasingly brings the solvency of the government into question.

State Governments:

Will likely have numerous defaults. The failure of one or more State governments will necessitate another bailout from the Federal government, at a time where the Federal government is already under tremendous financial stress. The bailouts will further increase the deficits, which will further pressure interest rates as investors increasingly shun Federal debt in fear of a Federal default.

Legislation & Taxes:

Will all increase. The burdens imposed upon the free market from the central planning Socialism of the State will increase as Obama and cronies increasingly try to maintain some semblance of knowing what the hell-is-going-on.

Protectionism & Tariffs:

Will again feature. The form will however increasingly focus upon the exchange system of international currencies. With all fiat currencies being devalued, in an attempt to kickstart exports, the result will be an increase in import costs, and a worsening trade balance. Tariffs will appear as cheaper [more devalued currencies] imports threaten American home based industries.